Holiday Party Tax Deductible 2025. To qualify for the 100 percent. While entertainment expenses are generally nondeductible, there are a few exceptions where these costs may be deductible for tax purposes:

The short answer is yes, holiday parties can be tax deductible, but there are some important caveats to keep in mind. Navigating business holiday party expenses:

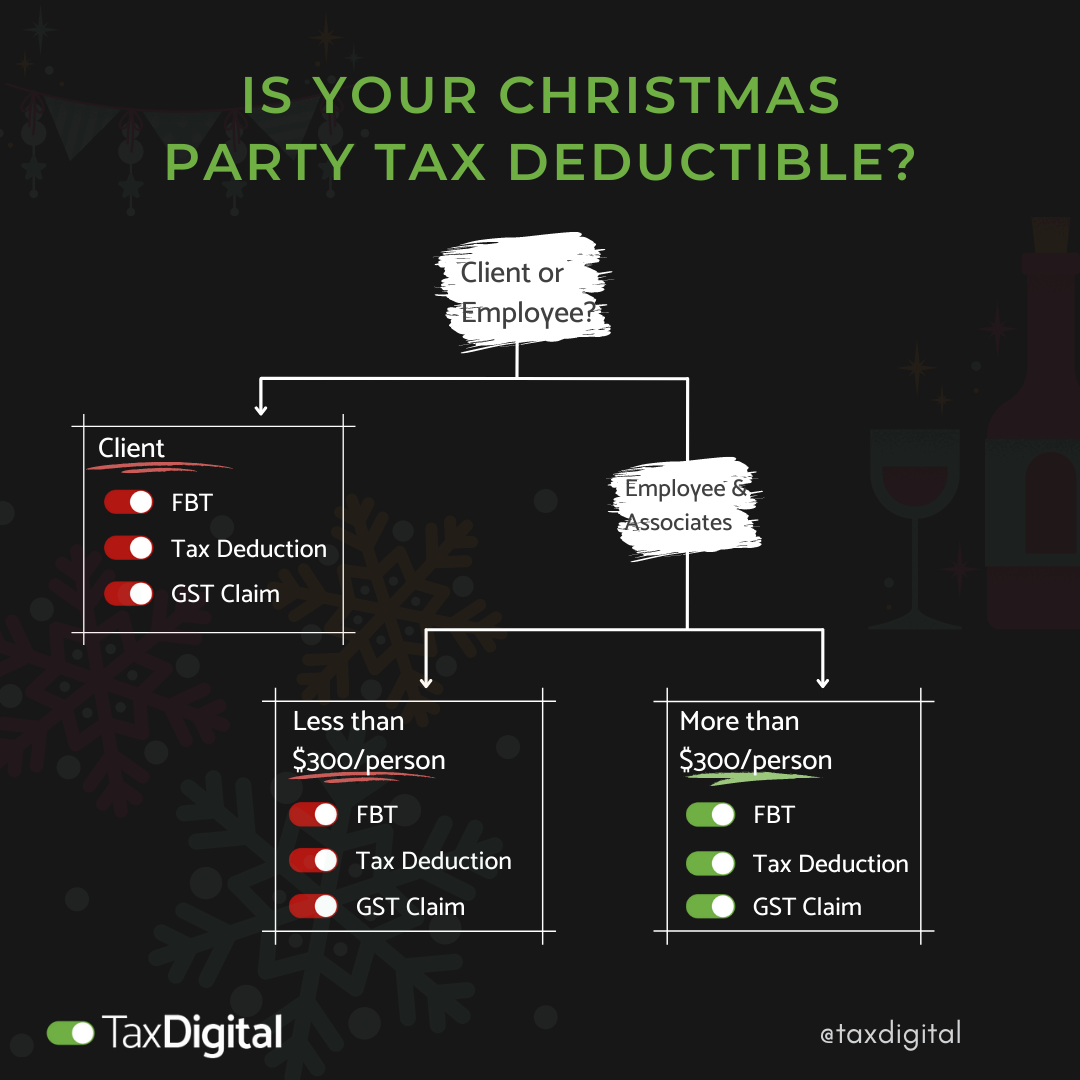

Tax Deductible? Christmas Parties and Gifts Tax Digital, The short answer is yes, holiday parties can be tax deductible, but there are some important caveats to keep in mind. Navigating business holiday party expenses:

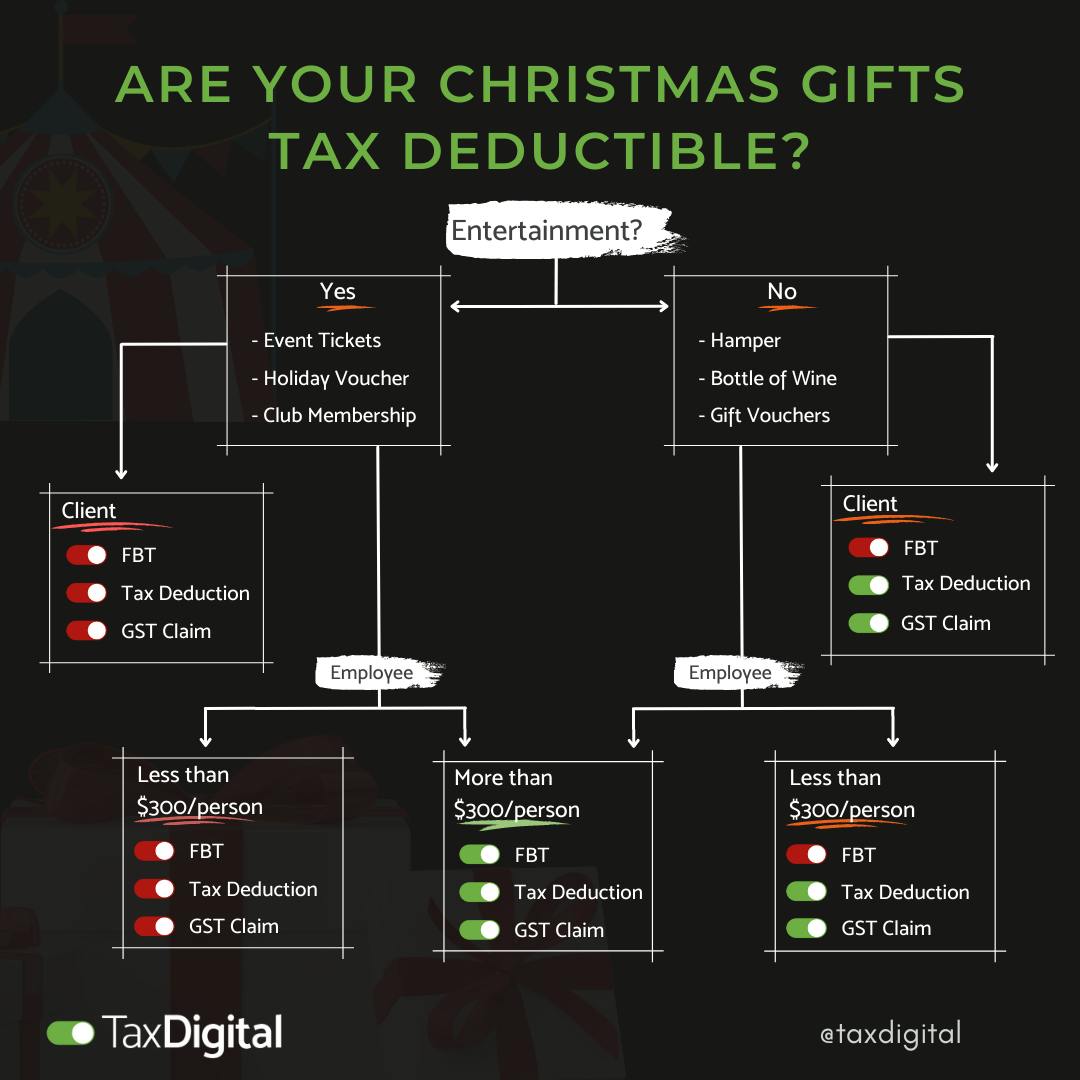

Tax Deductible? Christmas Parties and Gifts Tax Digital, Here are some of the most common exceptions that may still be tax deductible in 2025—expenses for events like the company holiday party or rewards trip;. Yes, company holiday parties are tax deductible in 2025.

How To Get Your Work Christmas Party Tax Deductible, The good news is that holiday parties for employees generally are fully deductible for employers, with no tax implications for employees. · food for company holiday parties (100%) · food and beverages given to the public (100%) · dinner for employees working late at the office (100%) · business.

Is Your Company’s Christmas Party Tax Deductible? Aston Shaw, The cbdt circular dated april 23, 2025 states: To qualify for the 100 percent.

What Christmas party expenses are tax deductible?, These entertainment events are subject to the 50%. But, it is always recommended to consult with a qualified tax professional or accountant to determine the tax deductibility.

Benefits for Employees Through Holiday Parties Are Holiday Party, Here are some of the most common exceptions that may still be tax deductible in 2025—expenses for events like the company holiday party or rewards trip;. Yes, company holiday parties are tax deductible in 2025.

Is your work Christmas party tax deductible? Raw Accounting, 100% of the costs associated with throwing a party for employees and their. These entertainment events are subject to the 50%.

Can Christmas Parties Be TaxDeductible?, Things like free coffee, donuts, and snacks provided at the workplace, as well as onsite meals for employees working overtime, are considered “meals provided for the. Must be for employees & their spouses.

Are Christmas Party Expenses Tax Deductible? ExpenseIn Blog, · food for company holiday parties (100%) · food and beverages given to the public (100%) · dinner for employees working late at the office (100%) · business. Maximizing deductions for holiday parties.

The Employer's Guide to Deducting Company Holiday Party Expenses, These entertainment events are subject to the 50%. If you invite a blend of.